Hot Topics

Three Minute Update

May 8, 2025

By now you’ve seen data comparing the first quarter of 2025 with Q4 of 2024 which shows how the new three-minute qualifier has changed the ratings landscape.

By now you’ve seen data comparing the first quarter of 2025 with Q4 of 2024 which shows how the new three-minute qualifier has changed the ratings landscape.

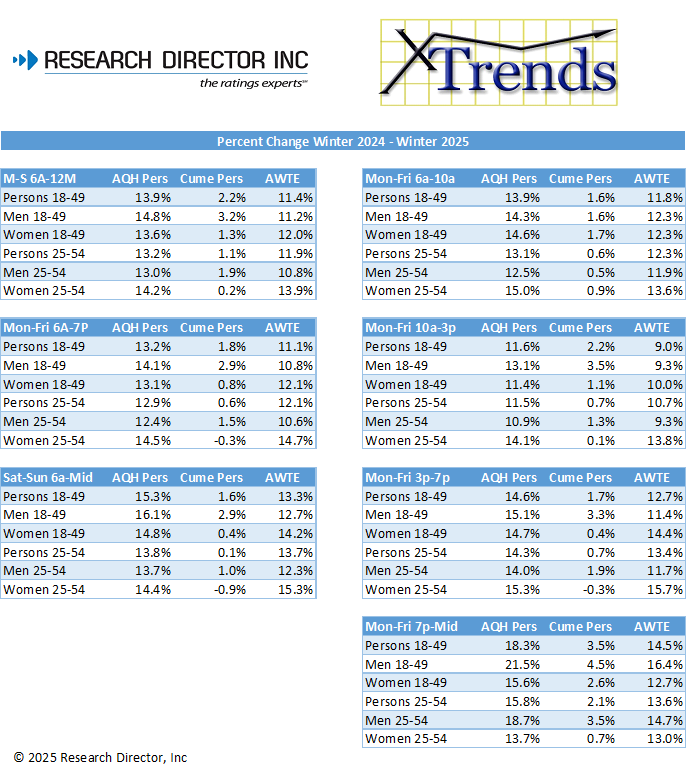

We decided to take a different tack on this by comparing Q1 2024 with Q1 2025 to (hopefully) get a more apples-ish to apples-ish comparison. We also wanted to go a bit deeper into the data so we partnered with the math mavens from XTRENDS to look at dayparts and demos. In our comparison we examined six demographics: Persons, Men and Women for both 18-49 and 25-54. We looked at the changes in AQH Persons, Cume Persons and Average Weekly Time Exposed (OK, TSL).

This was based on the market totals from 48 of the 49 PPM markets that are available to us.

The chart below lays out all the data. Here are a few takeaways:

- As expected, of the two components that make up AQH persons the growth was driven by TSL. This makes sense because to increase cume in any market you would have to capture listeners who listened for fewer than five minutes in only one quarter-hour for an entire daypart. They would only have to have one three-minute occasion in a daypart to count as new cume.

- There was not a dramatic difference in AQH gain between A25-54 (+13.2%) and A18-49 (+13.9%). This was for Total Week.

- However, for the same time span W25-54 increased more than M25-54 14.2% to 13.0%. The gap in Midday was even larger: 14.1% to 10.9%.

- Speaking of Middays, it appears to be the daypart that experienced the least amount of AQH increases. For A25-54 the two biggest daypart increases were M-F 7P-12M and M-F 3-7P. For A18-49 it was M-F 7P-12M and Weekends.

You can see all the changes in the chart below, but we have a few other observations:

- Every market will be different. Dive into your own numbers to see what the changes are for your station(s). Focus on AQH Persons, not share, to see where the real growth came from.

- While we might have been expecting larger increases this remains a net positive for radio.

- This is not “new” listening. It has always been there but wasn’t being counted. Advertisers have been benefitting from this “added value” for years.

- Comparing years has its disadvantages. Q1 of 2024 had different weather, different events and – most importantly – different panelists than Q1 of 2025.

Keep your eye on our blog for upcoming comparisons based on formats.

Again, we want to thank the crew at XTRENDS for gathering this data for our analysis.

Comments